Introduction:

Banks occasionally need an introduction from Authentication of identity a current account holder in order to open a new account. Building trust and honesty with this introduction.

Nominee Details:

Candidates are required to submit nominee information Authentication of identity for their bank account. A nominee is the individual designated to receive the cash in the terrible event that the account holder passes away.

Personal Information:

To open an account, you must provide some basic personal information, like your name, birthdate, occupation, and contact information.

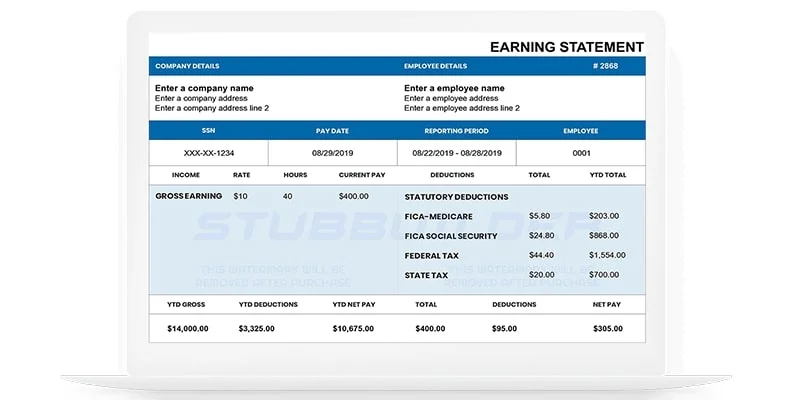

Income Proof:

Income documentation, such as pay stubs, income tax returns, or Form 16, may be required for specific types of bank accounts or greater transaction limits.

Business Proof (For Business Accounts):

Income documentation, such as pay stubs, income Authentication of identity tax returns, or Form 16, may be required for specific types of bank accounts or greater transaction limits.

Partnership Deed or Memorandum of Association (For Partnership/Firm Accounts):

A partnership deed or Memorandum of Association (MOA) is required for any partnership or firm accounts.

In-Person Verification (IPV):

Many banks require an IPV procedure in which the applicant must physically visit the branch for verification.

Conclusion:

Opening a bank account in India is a relatively straightforward process, provided one is armed with the necessary documents. The documentation requirements may vary from bank to bank and the type of account sought. It is advisable to check with the specific bank beforehand to ensure you have all the required documents, making the account opening process seamless and efficient. By being prepared, individuals can embark on their financial journey with confidence and avail the numerous benefits of having a bank account in India.